Client Logins

EQUIPT LOGIN

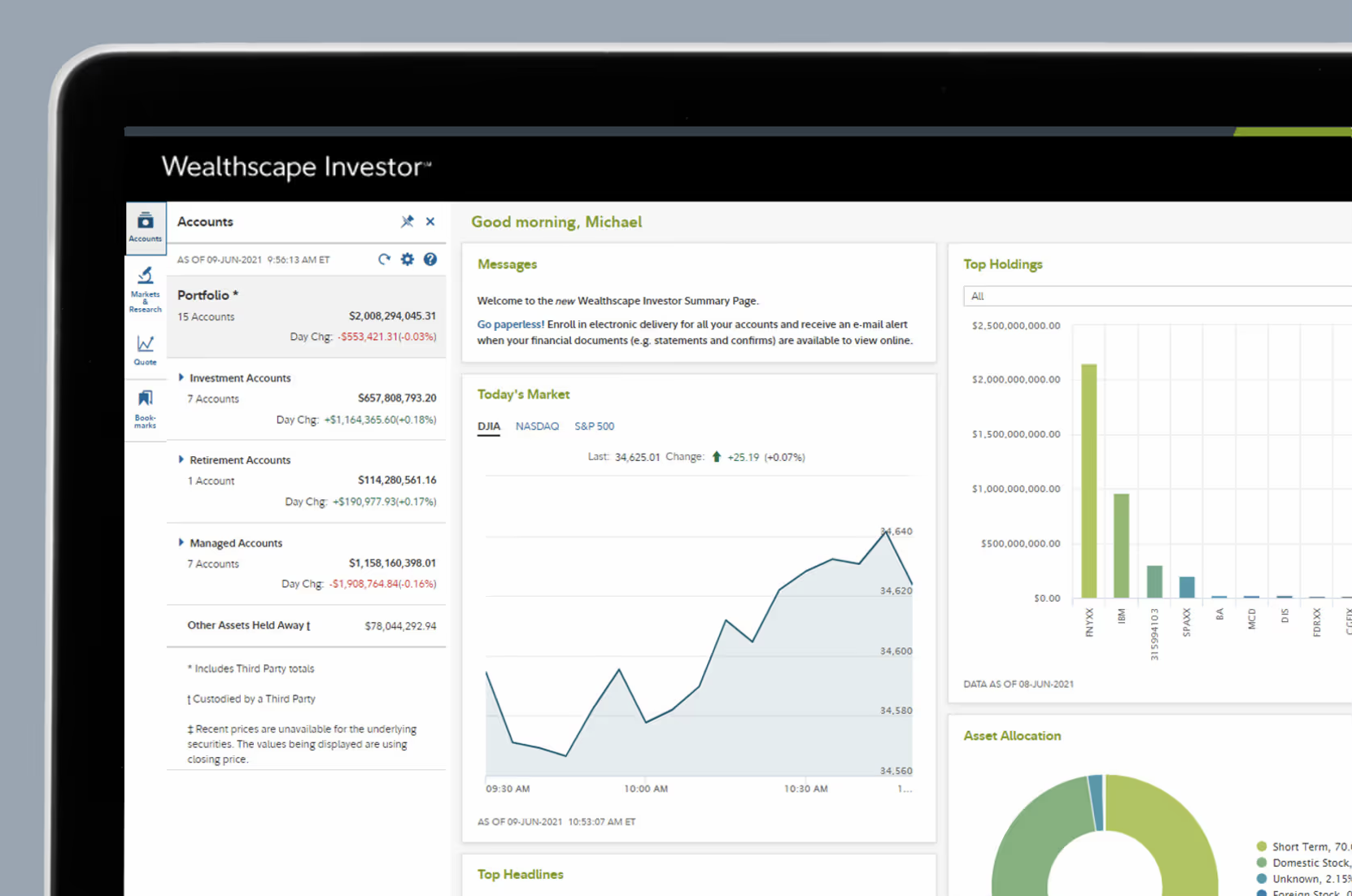

WEALTHSCAPE login

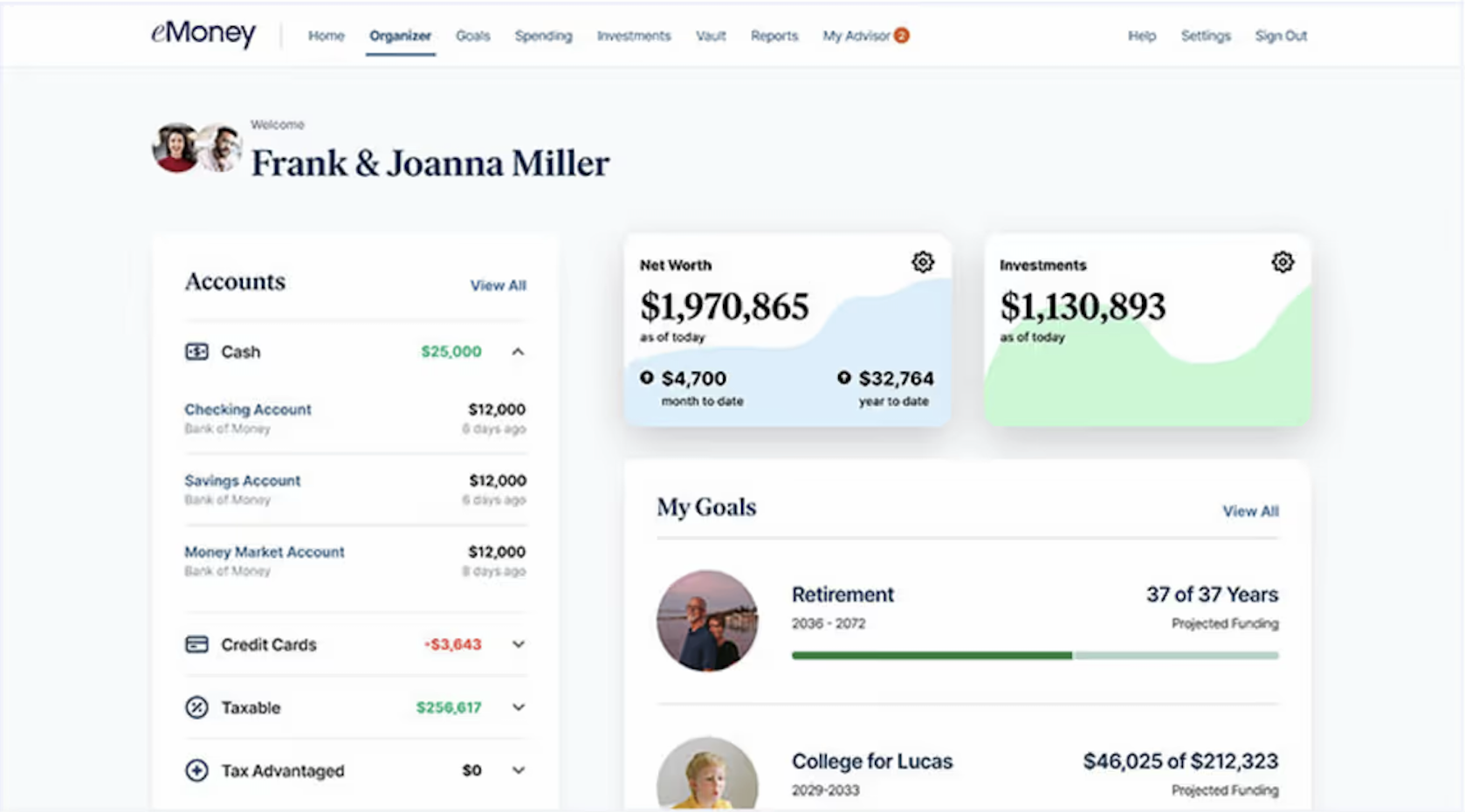

emoney login

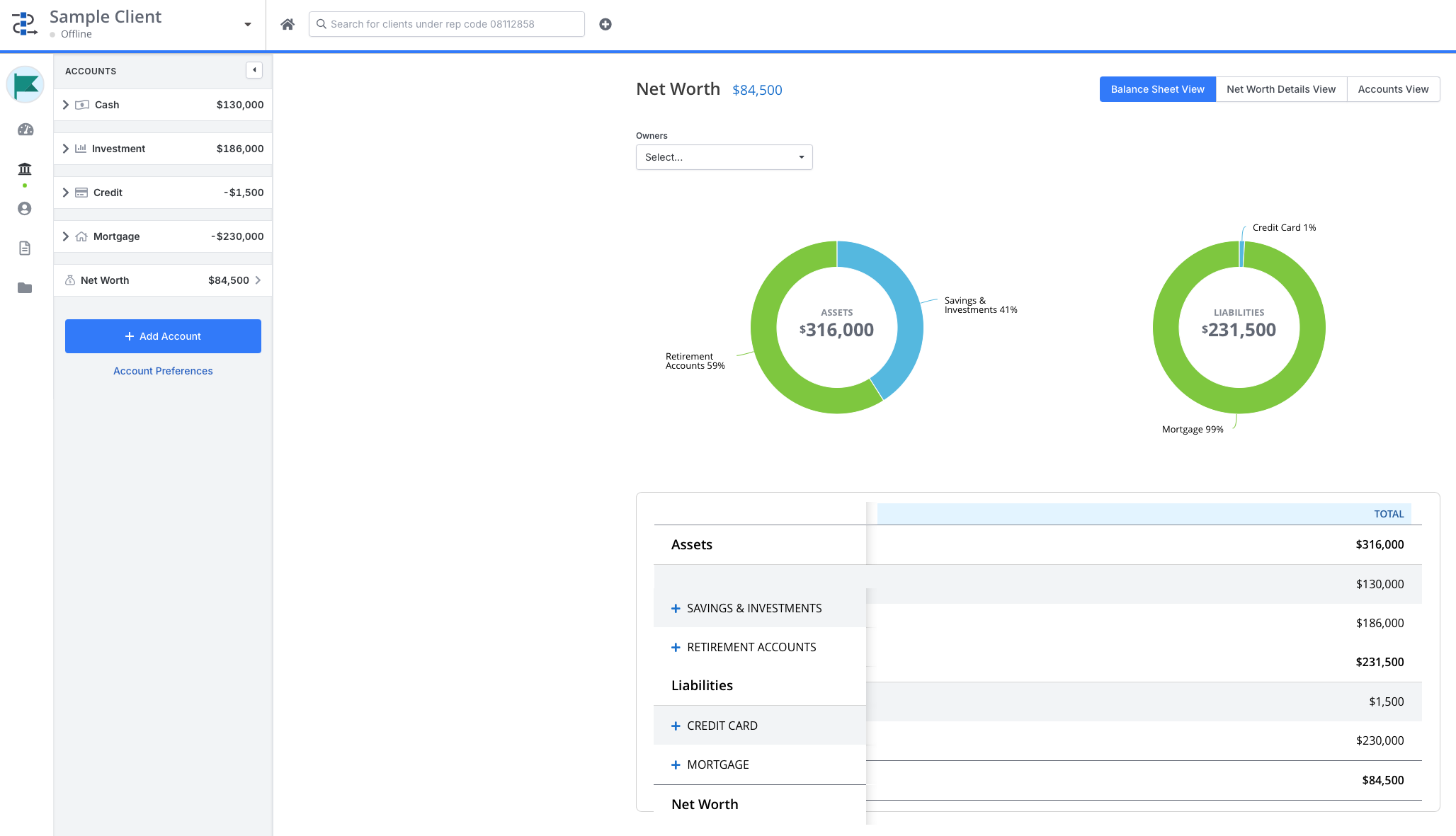

Investment Provider XChange (IPX)

Aspire Financial

Orion Portfolio Solutions

contributions

TCG Services

Envoy Plan SVC INC

TSACG & US Omni

What is a 403(b) retirement plan?

A 403(b) is a retirement plan designed specifically for teachers, faculty, and nonprofit employees. It allows you to contribute a portion of your paycheck toward retirement on a tax-deferred or Roth basis, helping you build long-term savings directly from payroll.

But while the concept is simple, the way a 403(b) actually works — and how effective it is — depends on the choices you make along the way.

-

For many educators, a 403(b) is a foundational part of retirement planning — but it shouldn’t exist in isolation.

The right strategy depends on:

Your years of service

Pension benefits (if applicable)

Other retirement accounts

Tax considerations

Long-term income goals

That’s where a personalized conversation matters.

-

This is where your money is invested and where fees, fund options, and long-term growth are determined.

-

You choose how much to contribute, and the money is deducted automatically through payroll. This amount can be changed anytime by you or your advisor.

-

The TPA approves and processes your salary reduction, ensuring everything follows IRS and district rules.